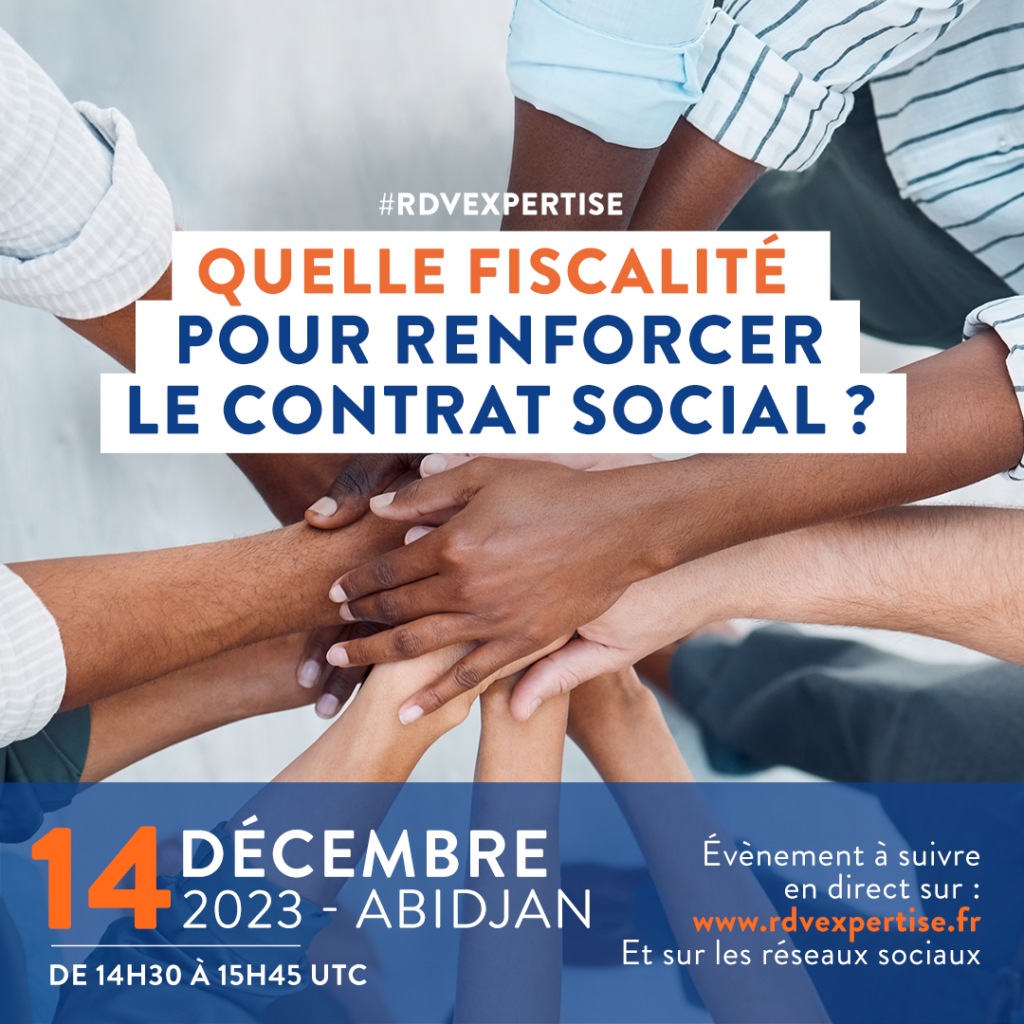

How can tax system strengthen the social contract?

How can tax system strengthen the social contract?

According to the Larousse dictionary, a tax is a "deduction made by authority and on a definitive basis from the resources or property of individuals or communities, and paid in money to meet the expenses of the general interest of the State or local authorities".

Yes, taxation can mobilize the resources needed to run the State and make public investments.

Nevertheless, its missions go further: taxation influences the decisions of economic players. It is a public policy instrument that can promote social justice, in response to structural or cyclical imbalances. It can also be a vector for citizen participation, and a condition for acceptance of the legitimacy of institutions.

In other words, paying taxes means accepting the social contract and giving ourselves the means to live together.

If, as we have said, taxation plays a special role in the construction of society, is a low tax burden systematically synonymous with a weakened social contract?

What implications do these figures have for living together in countries that collect less?

Is the politico-institutional instability characterized by several coups d'état in the sub-region, indirectly, a manifestation of the difficulties experienced by countries in proposing a healthy and fair social contract?

Should the effectiveness of a tax policy be judged solely by the amount of revenue raised?

In other words:

How can we introduce a tax system that meets the challenges of financing the State's needs, while at the same time creating a social bond that enhances social cohesion and confidence in institutions?

(Re)watch the videos broadcast during the live :

Speakers

Introduction

Jérémie Pellet

CEO, Expertise France

Round table 1

Analysis: tax systems struggling to fulfill their missions,

for economic, political and social reasons

Oral Williams

Director, AFRITAC West (FMI)

Denis Cogneau

Professor at the Paris School of Economics (PSE)

Director of Research at the Institut de Recherche pour le Développement (IRD)

Director of Studies at the Ecole des Hautes Etudes en Sciences Sociales (EHESS)

Thialy Faye

Economic Justice Program Manager (OXFAM)

Stéphane Soumahoro

President, Côte d'Ivoire Economic Journalists Association

Nouveau Regard

Intellectual property and copyright in Côte d'Ivoire

A'salfo

Singer with the group Magic System

Karim Ouattara

Managing Director, Bureau Ivoirien du Droit d'Auteur (BURIDA)

Round table 2

Tax practices that renew the social contract

Ouattara Sié Abou

Director General of Taxes, Direction Générale des Impôts de Côte d'Ivoire (DGI)

Sultan Toure

Director of Public Investment Programming (Ministry of Planning and Development, Côte d'Ivoire)

Hélène Lavoisier

Head of the "trust relationship" mission at the French Public Finances Directorate General (DGFiP)

Nicolas Orgeira Pillai

Research Officer at the International Center for Tax and Development (ICTD)

Moderation

Gallagher Fenwick

Great reporter

Re(voir) les dernières éditions des Rendez-vous de l'Expertise

What are the solutions for sustainable and effective universal health coverage?