14 December 2023

Taxation and social contract

Yes, taxation helps mobilize the resources needed for the functioning of the state and for public investments.

However, its missions go beyond this: taxation influences the decisions of economic actors. It is a public policy instrument capable of promoting social justice, in response to structural or cyclical imbalances. It can also be a vehicle for citizen participation and a condition for the acceptance of the legitimacy of institutions.

In other words, paying taxes means accepting the social contract and giving ourselves the means to live together.

- If, as we have said, taxation plays a particular role in the construction of society, is low tax pressure systematically synonymous with a weakened social contract?

- What are the implications of these figures for living together in countries that collect less?

- Is the political and institutional instability characterized by several coups d’état in the sub-region, indirectly, a manifestation of the difficulties experienced by countries in proposing a healthy and fair social contract?

- Should the effectiveness of a tax policy be judged solely on the basis of the revenue raised?

Expertise France projects related to entrepreneurship and diasporas

Expertise France projects related to entrepreneurship and diasporas

Speakers

Introduction

Jérémie PELLET

Managing Director, Expertise France

Grand angle 1

The observation: tax systems that struggle to fulfill their missions, for economic, political and social reasons

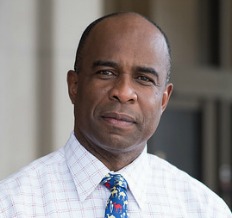

Oral Williams

Director of AFRITAC West (IMF)

Denis Cogneau

Professor at the Paris School of Economics (PSE), Research Director at the Institute for Research for Development (IRD), Director of Studies at the School of Advanced Studies in the Social Sciences (EHESS)

Thialy Faye

Economic Justice Program Officer (OXFAM)

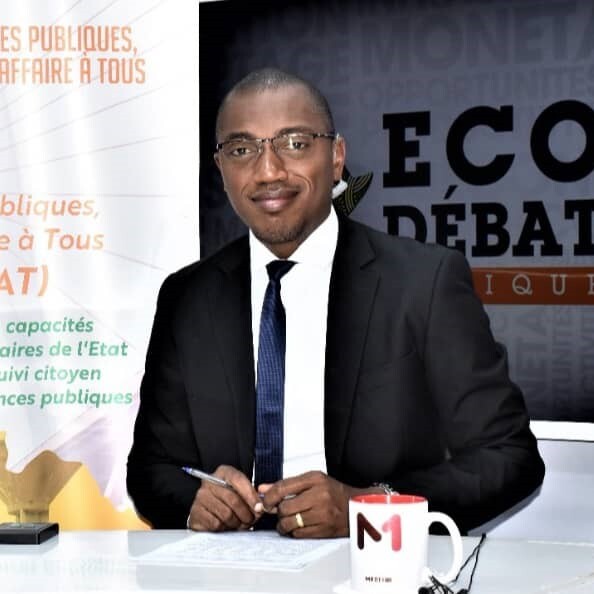

Stéphane Soumahoro

President of the Association of Economic Journalists of Côte d'Ivoire

Grand angle 2

Tax practices that renew the social contract

Ouattara Sié Abou

Director General of Taxes, General Directorate of Taxes of Côte d'Ivoire (DGI)

Sultan Toure

Director of Public Investment Programming (Ministry of Planning and Development of Côte d’Ivoire)

Hélène Lavoisier

“Trust relationship” mission manager at the General Directorate of Public Finances (DGFiP)

Nicolas Orgeira Pillai

Research Fellow at the International Centre for Tax and Development (ICTD)

Nouveau Regard

A’salfo

Singer of the group Magic System

Karim Ouattara

Director General of the Ivorian Copyright Office (BURIDA)

Perspectives

Moderation

Gallagher Fenwick

Moderator